One of the ways companies show employees they appreciate their hard work is through gift-giving. It’s an innovative, flexible option that allows recipients to choose what they want for a gift. So you’re on the right track if distributing gift cards to your employees is a plan. But you need to keep your tax concerns in mind. So perhaps, you’re wondering how the IRS (Internal Revenue Service) views gift cards.

Is there tax on gift cards, or do gift cards have tax? This article will give you all the information needed to move forward with gift cards as an employee incentive.

Are Gift Cards Taxable?

Yes, gift cards are taxable. The IRS views gift cards as a supplemental wage (e.g., bonus or sales commission), which is why they are subject to taxes – Medicare, Social Security, Federal and State income taxes (as applicable), and Federal Unemployment (FUTA).

Gift cards are a type of fringe benefit employers can give employees in addition to regular wages. And while some fringe benefits aren’t taxable, gift cards are since they are cash equivalents. Therefore, taxes apply using the same rules as any other type of taxable benefit.

Also, you can’t file gift cards under the “de minimis fringe benefits. De minimis refers to any low-value item given to employees infrequently, such as holiday parties, a fruit basket, etc. Neither employee nor employer has to account for this kind of benefit on their taxes.

Are Gift Cards Taxable To Employees

Yes, gift cards are taxable to employees — anyone you give a gift card to must claim it on their tax return. If you’re ever unsure, one way to think about it is anything used in place of money is considered additional income. The IRS has this rule in place partly to ensure enterprises don’t avoid paying taxes by giving employees bonuses in the form of gift cards.

Are Gift Cards Taxable To Non-Employees?

You must withhold taxes on gift cards the same as any other supplemental wage or pay. This includes withholding federal income, Social Security, and Medicare taxes from the gift card amount. You may also need to withhold state income tax depending on your location.

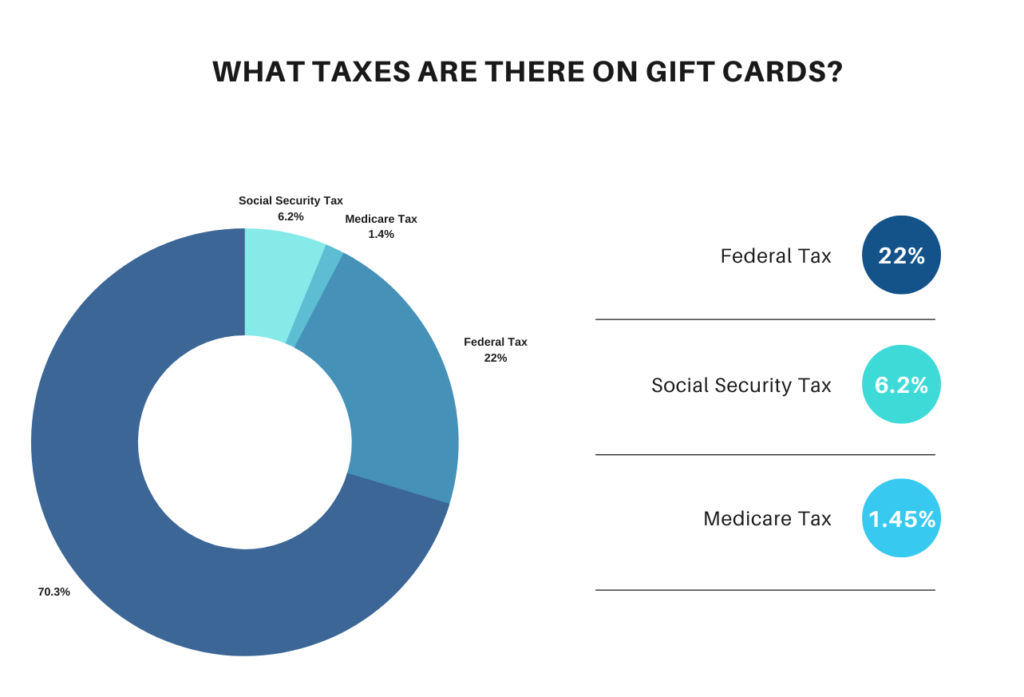

The rate is 22 percent for federal income taxes, and you can collect it using the percentage or aggregate method. The percentage method is as it sounds exactly – straightforward. The aggregate method means including the gift card amount with the employee’s regular wages and withholding taxes that way.

As for the other taxes, it’s 6.2 percent for Social Security, and Medicare is 1.45 percent. Additionally, keep in mind that, like the federal government, many states also have a supplemental withholding tax rate. So you’ll need to withhold that tax accordingly if applicable.

How Are Gift Cards Taxed?

In the U.S., a cash gift will always be taxable, no matter the amount. That means even $5 gift cards don’t qualify as a de minimis fringe benefit. It’s also the responsibility of the employer to report every gift given to employees. The employee also must report everything on their tax return.

As an employer, the easiest way to calculate taxes to withhold is by using the percentage method. For example, a $50 gift card would be $11 in federal taxes after multiplying the gift card value by 22 percent ($50 X 0.22).

Then, multiply the value by 6.2 percent to determine the Social Security tax amount. For example, that amount would be $3.10 ($50 X 0.062). But keep in mind that no Social Security tax is necessary if the employee has reached the wage base for Social Security.

The next step will be to determine the Medicare tax, which is $0.73 ($50 X 0.0145). Note that this won’t apply if an employee is responsible for additional Medicare tax.

Now, add all the tax amounts and remove from the gift card value of $50 to get the total your employee would receive. Here’s that calculation:

$11 + $3.10 + $0.73 = $14.83

$50 – $14.83 = $35.17 (this is what the employee receives)

Do You Want To Buy Gift Cards In Bulk For Your Employees?

Employers could give employees cash prizes or gift cards in the past for amounts less than $25 without tax concern. However, that’s no longer true, as you now know. All cash gifts, including gift certificates and gift cards, are taxable wages unless excluded by a tax regulation or code. But even so, gift cards remain the most desired by employees as a reward – 69 percent of employees prefer gift cards.

So consider Awards2Go if you think your employees deserve appreciation. We offer prepaid Visa gift cards for companies, providing fully customizable solutions that allow you to alter the color, logo, emboss your cards, and more. In addition, we can accommodate orders of all sizes – you’ll securely receive your order at the destination desired, be it 1000, 100,000 cards, or more.

There’s no better way for organizations to say “thank you,” motivate and congratulate teams than gift cards.

Start Rewarding with Awards2Go

Take advantage our low per card fees, flexible load amounts, customized messaging, low cost company-branded design, rush delivery, and more.

Get Visa Cards